Introduction: A Bold Corporate Pivot

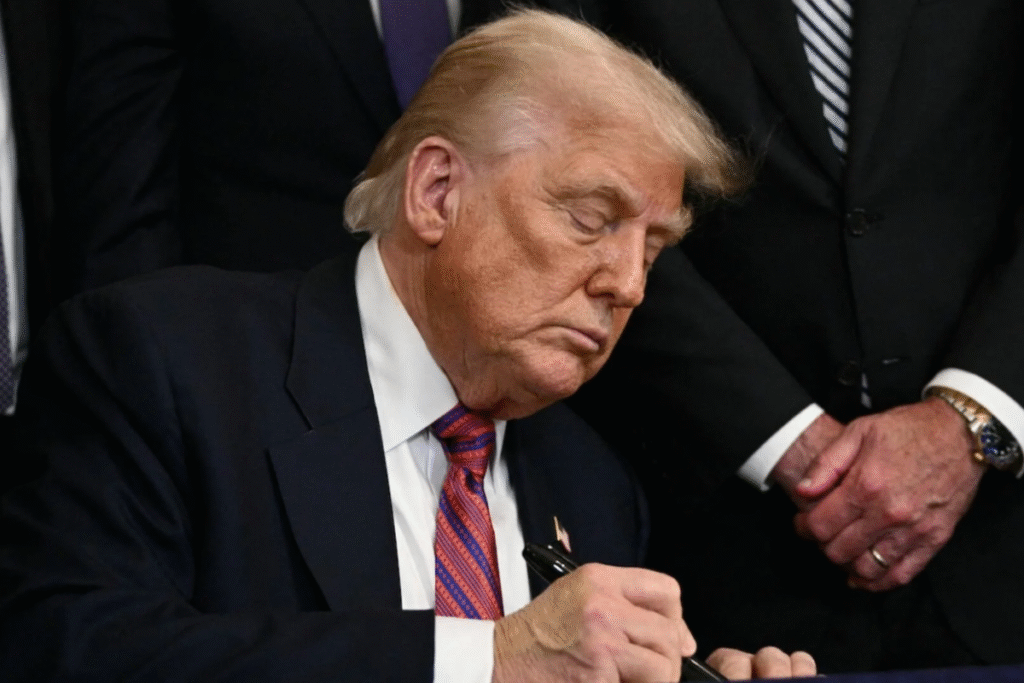

When Trump Media apostas fully on bitcoin acquisition, the market pays attention. Three last years July 21, Trump Media and Technology Group (TMTG), the parent company of Truth Social, announced a staggering $US2 billion worth of bitcoins acquired as part of a newly revealed strategy in the new crypto treasury. The statement was categorical: crypto-reserves will provide the oxygen for future growth. I’ll explain today what this means-from precedent set by other corporates to ripple effects on policy and investor psyche.

What Trump Media Announced

A) $2 B Bitcoin Acquisition

TMTG announced that it bought approximately $2 billion worth of bitcoin and bitcoin-related securities. At the moment, that represents nearly two-thirds of its $3 billion in cash. The plans currently further to grow that holding.

B) $300 M in Bitcoin-Linked Options

The company has also committed another USD 300 million to bitcoin-linked options with an understanding that they will be converted into bitcoin as per the condition of the market.

CEO Devin Nunes stated: “These assets help ensure Company financial freedom, safeguard against discrimination by financial institutions, and create synergies with the utility token we are planning to introduce across the Truth Social ecosphere.”

Why This Strategy Makes Sense

First, the addition of bitcoin to the corporate treasury would hedge the company against inflationary and foreign currency risks and possible discrimination by banks in lending; secondly, TMTGs often pre-establish credentials for cryptos in expectation of their token initiatives-in Truth Social’s case, this would be a utility token-and finally, bitcoin gives liquidity and upside, conditional on the markets still doing well under a pro-crypto policy in the U.S.

The exposure reduction in conventional financial institutions gives a balanced assessment that is particularly robust as we move forward into a future that is increasingly determined by the crypto economy.

Echoes of Michael Saylor and MicroStrategy

Michael Saylor adopted this model and made it a big deal by committing most of his treasury into bitcoin. Consequently, the stock benefited significantly.

Now, Trump Media imitates

This pattern is developing further across the business horizon:

- Ether Machine would be the institutionalized holder of his ETH

- BitMine Immersion too has substantial ether holdings.

So much popularity this strategy carries that TMTG ends up being one among the top five corporate bitcoin treasury owners in existence.

Market Reaction and Price Momentum

Markets reacted almost immediately. With the announcement, TMTG shares surged between 5 and 7 percent. In parallel, bitcoin crossed the mark of $120,000 and recently reached an ATH beyond $123,000.

Signals from investors, like this, in fact, signify strong confidence. They indicate that the market somehow regards the reserves of bitcoin as not something gimmicky, but rather strategic.

Strategic Implications for U.S. Crypto Policy

It is, after all, against a backdrop of major innovation concerning crypto in Washington:

- The GENIUS Act, the first federal law governing stablecoins, was signed by Trump.

- The U.S. initiated a Strategic Reserve of Bitcoin by creating treasury assets using seized government bitcoins to even further wrap up in the budget.

- U.S. regulatory agencies’ enforcement activities against exchanges like Coinbase and Binance were halted by them.

Biggles, of all corporate participants, emboldened today is TMTG. Spurred on by clarity, alignment with policy, they are now bold enough to take on digital asset holdings aggressively.

Risks and Criticism

Of course, skeptics argue against putting two-thirds of a company’s reserves into one volatile asset.

- Bitcoin’s price attention looms large in the possible severe fall.

- Questions arise: Is TMTG too exposed?

- There are ethical issues surrounding conflicts of interest-triggered questions about whether political promotion will be beneficial to private portfolios.

Some analysts argue that misconception may occur when less-savvy investors assume bitcoin is a safe store for their businesses. The very notion of a “strategic reserve” has raised eyebrows as some compare that to putting crypto alongside gold or oil while others see it as politicized.

What It Means for Investors

Several current trends for investors to note are these:

- Corporate Crypto Reserves Are Trending

If TMTG does well, expect many more companies to follow suit, and down the road, this could conceivably catch even mainstream firms, such as Apple or Tesla. - Pro-Crypto Policy = Big Upside

Results from TMTG show political tailwinds can be very instrumental with respect to value enhancement for crypto assets. - High-Risk, High-Reward

Investors should consider bonds, gold, and crypto together as part of a diversified portfolio and not isolated plays. - Token Synergy Coming

TMTG announced that it would launch a utility token soon on Truth Social and Truth.Fi. This Bitcoin reserve goes far beyond mere financial backing; it is structural and built for future growth of the ecosystem.

Conclusion

When Trump Media goes all in to buy bitcoins, it is more than just headlines; it becomes a flashpoint between corporate strategy, political policy, crypto markets, and even psychology of investors.

This outlay of $2 billion-usual in connection with a $300 million options play-smacks of the kind of blueprint laid down by earlier pioneers such as MicroStrategy. A declaration of intent more than a case of risk assessment;

Equally marks a change in norms: corporations are no longer silent about their cryptocurrency investments; instead, they are positively embracing it. The prevailing public policy in the U.S. is to favor digital assets.

Note: this kind of daring, however, comes not without cost.

In the end, for investors and commentators alike, one thing is clear: Trump Media’s acquisition of bitcoin will leave echoes. Future discussions about the legitimacy of crypto will be influenced by it as will adaptive policy changes and discussions around treasury managements. So, regardless if you are a crypto bull, policy analyst, or risk-aware investor, watch this space.

FAQs

A1. Trump Media’s $2 billion Bitcoin investment is part of a new treasury strategy aimed at diversifying its holdings and positioning the company within the growing Web3 and decentralized financial ecosystem. The move signals confidence in Bitcoin’s long-term value and aligns with broader trends of corporate crypto adoption.

A2. The investment marks a significant shift away from traditional asset reserves. By holding Bitcoin, Trump Media is betting on inflation-resistant, decentralized digital assets to protect and potentially grow its capital. It may also appeal to crypto-native users and investors who support decentralized values.

A3. Following the announcement, Bitcoin’s price spiked sharply as the market reacted to the scale and influence of the investment. It added bullish sentiment, especially as major media and political affiliations brought heightened attention to BTC’s mainstream acceptance.

A4. Yes. As of 2025, Trump Media’s $2 billion Bitcoin acquisition stands as the largest single crypto treasury buy by a media or communications firm. It surpasses prior moves by firms like MicroStrategy and Tesla in terms of percentage of treasury assets allocated to Bitcoin.

A5. Bitcoin remains volatile. A $2 billion investment exposes Trump Media to market swings, regulatory uncertainty, and long-term liquidity risks. However, proponents argue that Bitcoin’s limited supply and growing institutional support make it a strong hedge against fiat currency devaluation.

A6. It’s possible. Trump Media’s high-profile investment could inspire other media and tech companies to reassess their treasury models and explore Bitcoin or stablecoins as alternatives. Especially if BTC continues to appreciate, more firms may follow suit.