Introduction: Trump Signs the GENIUS Act

In his July 2025 signing of the GENIUS Act, which is a massive piece of legislation involving regulations on stablecoins and digital assets, former president Donald Trump shocked the markets into reacting. Crypto stocks rallied, Bitcoin rose over $120,000, and Wall Street began throwing cash into blockchain innovation.

The GENIUS Act may be the most groundbreaking development for crypto since the founding of Ethereum. But what is contained in this bill? And what is prompting investors to act like this is a green light for the new era?

What Is the GENIUS Act?

GENIUS Act, short for Government-Enabled National Integration for Uniform Stablecoins, establishes a federal regulatory framework for stablecoins and custodians of digital assets.

Key Provisions:

- Licensing for stablecoin issuers (with FDIC-style protections)

- 1:1 reserve backing requirements for USD-pegged coins

- Tax clarity for capital gains and staking income

- Guidelines for tokenized securities and digital bonds

- Permission for banks to custody and issue stablecoins

Suddenly, U.S. crypto regulation caught up with innovation, leading to unprecedented confidence from institutions and retailers alike.

Why Crypto Stocks Are Rallying

Confidence Returns to Wall Street

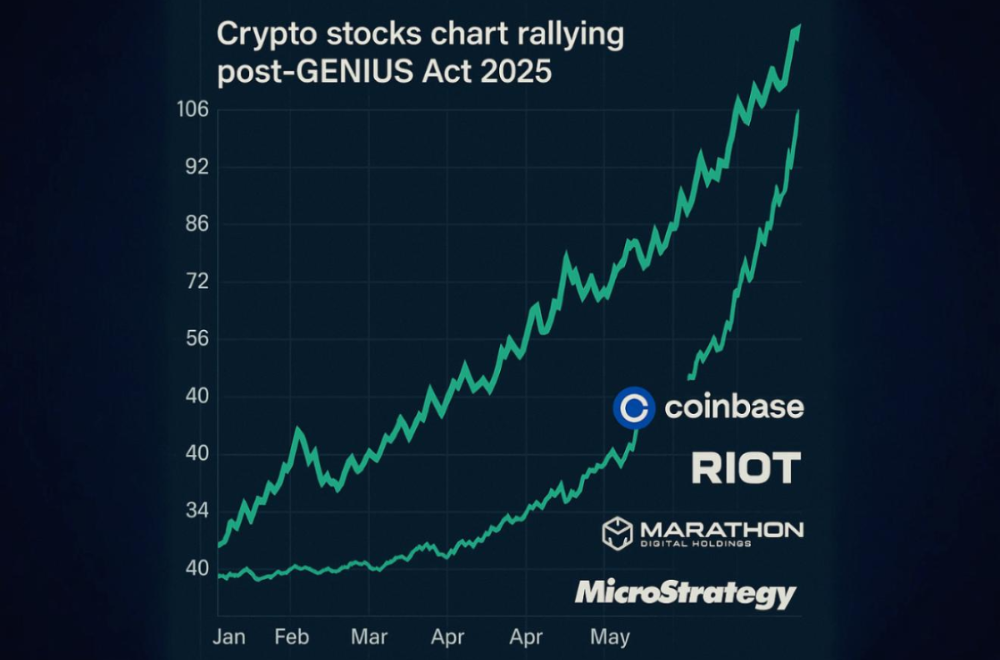

Once the signing of the GENIUS Act began, the stocks related to crypto, from Coinbase (COIN) to Riot Platforms (RIOT) and even microstrategy (MSTR), started climbing.

| Crypto Stock | Price (Pre-GENIUS) | Price (Post-GENIUS) | % Increase |

|---|---|---|---|

| Coinbase | $280 | $410 | +46% |

| MicroStrategy | $860 | $1,210 | +40% |

| Riot Platforms | $18 | $27 | +50% |

| Galaxy Digital | $9.50 | $14.20 | +49% |

Investors are treating crypto stocks as a proxy bet on blockchain’s future—and with the regulatory fog cleared, bullish sentiment is at an all-time high.

How the GENIUS Act Impacts Bitcoin

While the GENIUS Act does not primarily concern Bitcoin, its suffocating impact is enormous.

BTC is now seen as:

- A legitimized store of value under regulated markets

- A safe haven in a tokenized financial system

- A hedge against fiat devaluation, especially with stablecoins rising

Bitcoin’s value has registered an increase from $102K to $123K. Trading volumes now reached levels like that of 2021 and long-term holder metrics have established new records.

The GENIUS Act did not only boost Bitcoin but has strengthened its modern place in the financial ecosystem.

The Act’s Use of Stablecoins

Stablecoins Form the Basis of the Act

Under the GENIUS Act:

- Stablecoins are issued only by licensed entities

- Reserves must be held in U. S. Treasury Bills or in cash

- Monthly audits and transparency reports are mandatory

As a result, coins like USDC, PayPal USD (PYUSD), and JPM Coin have gained enormous traction.

Meanwhile, algorithmic stablecoins like Terra’s failed UST are effectively banned, giving rise to fully regulated, fiat-backed alternatives.

The total stablecoin market cap jumped from $290B to $450B within weeks.

Ethereum, DeFi & Tokenization Under the Spotlight

Ethereum could be the biggest indirect benefit of the GENIUS Act.

With clear rules around digital assets:

- DeFi protocols are thriving under compliant stablecoins

- RWA (Real-World Asset) tokenization is exploding—real estate, art, and bonds are moving on-chain

- Institutional-grade apps are being built using Ethereum and Layer 2s

| Sector | Growth Rate (Post-GENIUS) | Example |

|---|---|---|

| DeFi TVL | +58% | Aave, Compound |

| Tokenized Bonds | +70% | Franklin Templeton, BlackRock |

| ETH Price | +37% | $3,850 (from $2,800) |

The foundation of regulated banking is becoming Ethereum, not just “the tech.”

Institutional Confidence Post-GENIUS Act

For years, the biggest complaint from financial institutions was “lack of clarity.”

Now? That excuse is gone.

Who’s Jumping In:

- JPMorgan expanding stablecoin settlement

- BlackRock launching tokenized money market funds

- Goldman Sachs building a crypto custody division

- Vanguard issuing tokenized bond ETFs

The GENIUS Act validated the crypto sector in the eyes of institutional giants—and their capital is now flowing into both tokens and equities.

Public Sentiment and Retail Investor Behavior

Retail traders are back. Reddit forums, YouTube analysts, and TikTok influencers are buzzing with optimism.

Key trends:

- Searches on Google for “how to buy crypto stocks” increased by 540%.

- Coinbase saw 2 million new account signups in 2 weeks

- DeFi wallet downloads increased across mobile platforms

- Bitcoin was the #1 trending topic on Twitter the day Trump signed the bill

Retail FOMO is returning—but this time, it’s backed by real regulation and utility, not meme hype.

Risks and Unintended Consequences

Despite the excitement, there are valid concerns:

Centralization Risk:

- With only licensed issuers allowed, smaller decentralized players may be squeezed out.

Innovation Bottleneck:

- Regulatory compliance could slow down experimental DeFi projects.

Surveillance & Privacy:

- Some fear that regulated stablecoins mean greater financial tracking by authorities.

Though the GENIUS Act brings clarity, it may also bring centralized control, which runs counter to crypto’s original ethos.

Key Winners: Top Performing Crypto Stocks

Besides Coinbase and MicroStrategy, several companies have benefited:

| Company | Why It Rallied |

|---|---|

| Robinhood (HOOD) | Offers crypto trading—volume spiked |

| Block Inc. (SQ) | Integrated Bitcoin tools for merchants |

| CME Group | Expanding regulated crypto futures |

| Hut 8 Mining | Saw massive mining profitability boost |

Stocks with direct crypto exposure or regulatory readiness are seeing the greatest gains.

Global Ripple Effect: How Other Nations Respond

The GENIUS Act has global implications.

Immediate International Reactions:

- UK proposing similar stablecoin regulation

- EU speeding up MiCA (Markets in Crypto Assets) implementation

- Singapore launching government-backed tokenization pilot

- UAE welcoming U.S.-based crypto firms for expansion

If the U.S. becomes the “global regulator of crypto,” we could see a new standard emerge—driven by Washington rather than Geneva.

What This Means for the Future of Crypto

The GENIUS Act signals a paradigm shift:

- From speculation to infrastructure

- From volatility to stability

- From gray areas to clear regulations

The crypto space is maturing. The question is no longer, “Will crypto survive?”

It’s “How will crypto integrate into the next financial era?”

With clearer laws, safer stablecoins, and renewed institutional faith, we’re entering Crypto 3.0—an era built on utility, regulation, and legitimacy.

Investor Takeaways: Strategy in the Post-ACT Era

What Smart Investors Are Doing:

- Allocating to crypto equities like Coinbase or Galaxy Digital

- Accumulating Bitcoin & Ethereum on dips

- Exploring RWA tokens with real-world cash flows

- Avoiding unlicensed stablecoins and high-risk DeFi

- Staying informed on policy updates and FATF rules

In a regulated landscape, risk management becomes easier, but due diligence remains essential.

Final Thoughts: A Turning Point for Digital Assets?

The GENIUS Act may be remembered as the moment crypto went mainstream in America.

With Trump’s signature, an entire asset class transitioned from “shadow finance” to legitimate investment category.

Crypto stocks are no longer just speculative plays—they’re regulated proxies for the future of finance. And as adoption grows, the gap between traditional markets and blockchain will continue to shrink.

The rally isn’t just in prices—it’s in confidence.

FAQs

A1. The GENIUS Act (Government-Enabled National Integration for Uniform Stablecoins) is a U.S. federal law signed by Donald Trump in 2025. It provides legal guidelines for stablecoin issuance, mandates 1:1 reserve backing, and allows regulated banks to offer crypto services.

A2. Crypto stocks rallied because the GENIUS Act brought legal clarity to the digital asset market. Investors gained confidence in companies like Coinbase, Riot Platforms, and MicroStrategy, expecting more institutional adoption and regulatory safety.

A3. While the GENIUS Act doesn’t regulate Bitcoin directly, it boosts market confidence, increases institutional participation, and indirectly strengthens Bitcoin’s position as a store of value in a regulated ecosystem.

A4. Stocks like Coinbase (COIN), MicroStrategy (MSTR), Riot Platforms (RIOT), and Galaxy Digital saw major price increases. These companies are viewed as leading players in the regulated crypto space.

A5. The GENIUS Act offers stability and trust, but some worry it could hinder decentralized innovation due to strict compliance requirements. Still, many DeFi platforms are adapting to remain compliant.

A6. Investors should diversify across regulated crypto stocks, stablecoins, Bitcoin, Ethereum, and tokenized real-world assets. It’s also wise to stay updated on further policy changes and manage risk cautiously.

A7. Yes. Following the GENIUS Act, countries like the UK, EU members, and Singapore have started drafting similar legislation. The U.S. may now set the global standard for crypto regulation.